9 Steps to Prepare For Retirement Infographic Venngage

Entertainment expenses can cost $2,672 annually, one of the biggest expenses in retirement. While budgeting is essential, there are other strategies to make travel and entertainment more.

Retirement Budget Worksheet Templates at

Your working income is $70,820 and your annual expenses during retirement will be about 80% of this ($56,656). You have a 401 (k) with 3% matching contributions from your employer. Your account has $75,000 and you just opened a Roth IRA for tax diversification purposes and deposited $5,000 into it.

Free Editable Retirement Budget Worksheet by Template Designer Issuu

You'll find that some expenses can be reduced or eliminated, while others may even increase as you age. Here are 10 costs to include as you budget for retirement: Housing. Health care. Daily.

Retirement Savings Plans for Expats Smash your Goals!

Fidelity estimates that on average a 65-year-old retired couple needs $300,000 to spend on health care over the course of retirement 3. For planning purposes, you may want to factor in an even higher number, because many people experience above-average expenses—often due to chronic illnesses, longevity, or long-term care costs.

Write a Retirement Budget Harbour & Associates

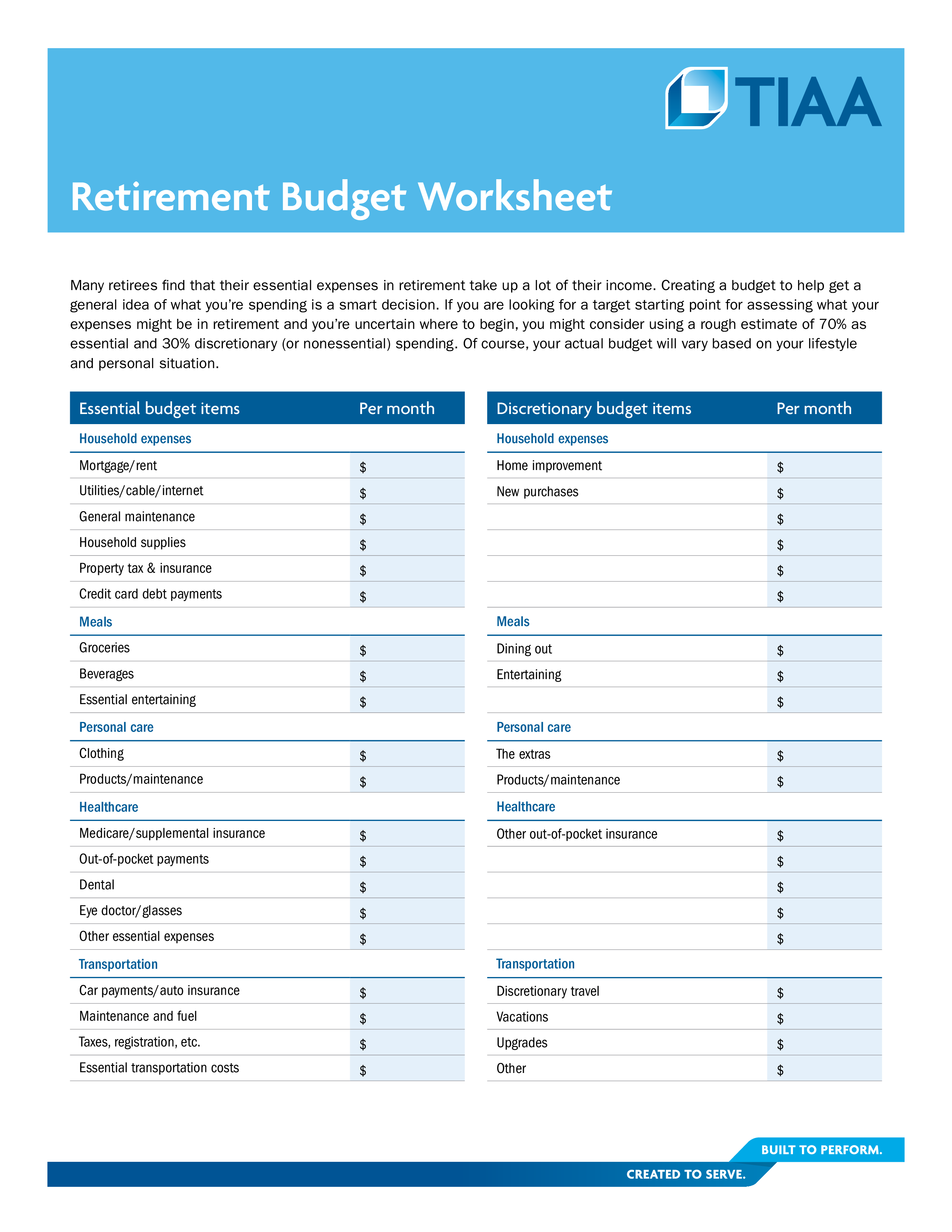

These are the steps in creating a retirement budget: (1) identify all expected expenses, (2) then categorize the essential and non-essential expenses, (3) list down all sources of income, (4) determine the monthly cash flow, and (5) adjust retirement goals and spending.

How Much Do You Need To Retire Comfortably It's Time To Set Your Goals

While healthcare is a major one — the average retiree spends $6,749 per year on healthcare, according to a recent Harvard study reported by Entrepreneur — it's not the biggest expense for most. The Harvard study found that housing, at a national average of $17,454 annually for retirees in 2021, remains the highest cost for the average.

7 major expenses in retirement (and how to prepare!) Clark Howard

Choose the way you want to enter your expense. Monthly. Annually. Enter your estimated expenses for each category, then click Calculate at the bottom to see your total. If you want to edit your expenses and recalculate your total, change the dollar amount in any field at any time. Housing.

How to Plan for the Top 3 Expenses in Retirement

Typical retirement expenses include housing, health care, food and transportation. Creating a budget for retirement is a simple matter of gathering and analyzing your essential and nonessential expenses and comparing your spending with your income. Understanding how your budget matches with your retirement income sources, such as Social.

How to do Retirement Planning? Step by Step Guide [Infographic

There are 4 categories on Fidelity's retirement preparedness scale. They measure your ability to cover estimated retirement expenses particularly in a down market. 3. Dark green: Very good (96 or over). On target to cover 96% or more of total estimated expenses. Green: Good (81-95).

Retirement Planning Guide for Seniors Lexington Law

For example, a retiree who earns an average of $63,000 per year before retirement should expect to need $44,000 to $57,000 per year in retirement. » Go deeper: Use our free retirement calculator 3.

7 Simple Ways to Estimate Your Retirement Expenses Wiseradvisor

People ages 65 and older had an average income of $55,335 in 2021. Average annual expenses for people ages 65 and older totaled $52,141 in 2021. 48% of retirees surveyed reported spending less than $2,000 a month in 2022. 1 in 3 retirees reported spending between $2,000 and $3,999 per month. 18% reported spending more than $3,999 per month.

6 Steps to Retirement Success Skye Planning Group Inc.

The standard monthly premium for Part B, which covers doctor visits and outpatient treatments, is $174.70 in 2024. The Part B annual deductible for 2024 is $240. Plan premiums for Part D, the.

How Much Do I Need to Retire Calculator Retirement Cost for Couples

To prepare for home expenses in retirement: Regularly maintain your home - On a regular basis, conduct a thorough inspection of your home and its systems in order to quickly identify and address any minor issues before they become major expenses. Establish a home repair fund - Similar to your emergency healthcare fund, set aside funds in a.

How Much Do I Need to Retire Calculator Retirement Cost for Couples

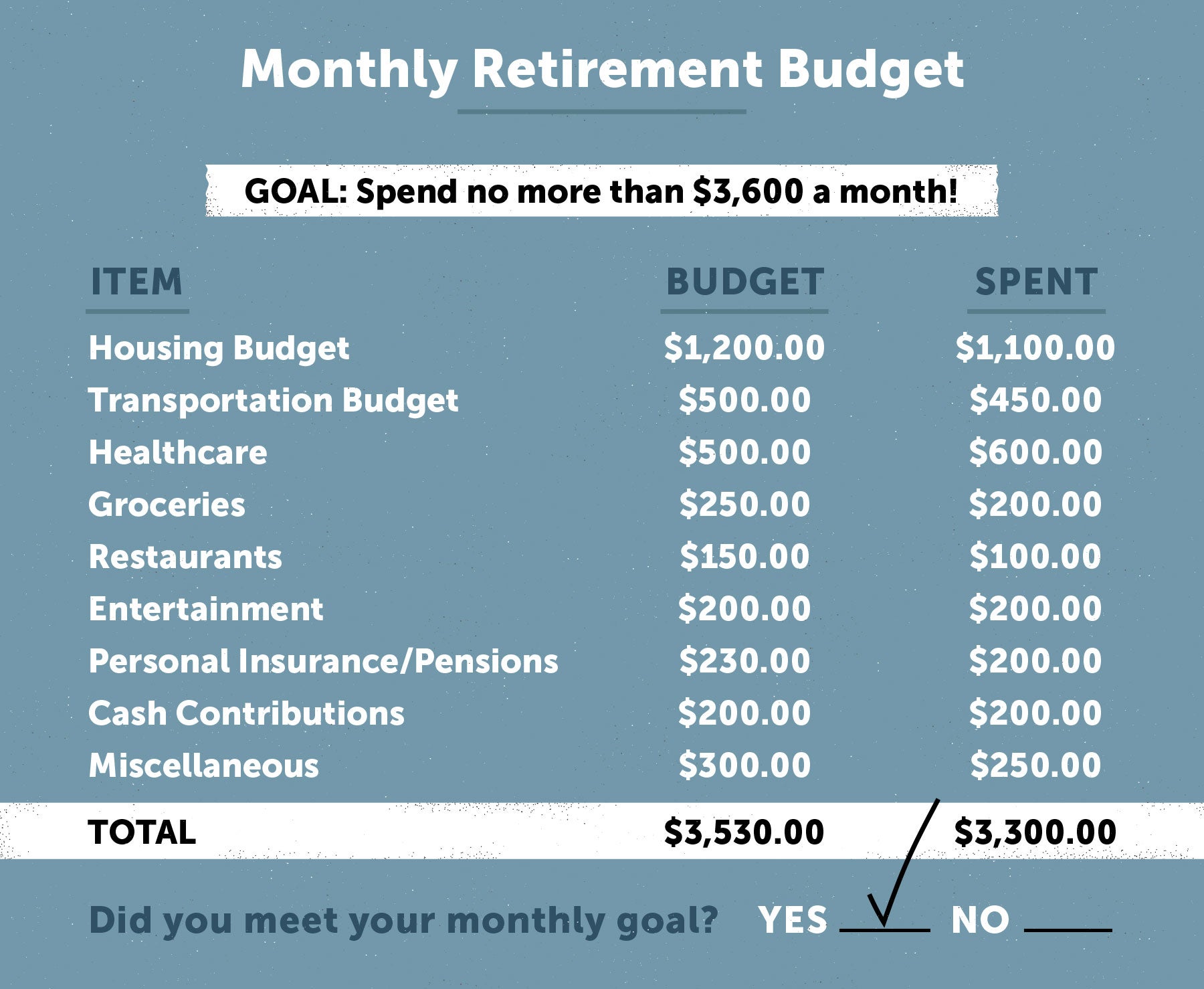

Your retirement budget balances your income against your expenses. You'll generally need about 80% of your former income to live comfortably in retirement. So, if you earned $100,000, your income from all sources should be $80,000. Calculate your monthly budget by subtracting your essential and nonessential expenses from your income. Written by.

8 Ways to Prepare for the Retirement You Want Edward Jones

Gas prices also helped fuel the increase as the average retail price per gallon was $4.67 in 2022 versus $3.19 in 2021 (per a recent Bankrate.com report). Engaging in a meaningful discussion about transportation expenses is critical as you prepare for retirement—especially for those set to live on a fixed income.

Best Retirement Calculator Annuity Association

How to Budget for Retirement Expenses. To budget for retirement, consider the 80% rule for needed money, the 4% rule for annual withdrawals, and use the Rule of 72 for investment growth and different types of retirement plans to cover expenses. Updated February 15, 2024. Start Your Free Plan.