How Much Does a Business Lawyer Cost? LegalMatch

Annual franchise tax: All LLCs in California must pay an annual franchise tax of $800. This fee is due each year to maintain good standing with the state. Registered agent fee: If you've hired a.

How Much Does It Cost To Hire a Lawyer To Sue My Employer in California

The cost of hiring a small business lawyer varies greatly depending on the type of legal services needed, the complexity of the matter, and the attorney's experience and fees. In general, small business lawyers in the United States charge anywhere from $150 to $350 per hour, with the average hourly rate being around $220.

How Much Do Small Business Lawyers Usually Cost? Smith Barid

Expert witness fees. Court reporter expenses. Medical record expenses. Deposition or hearing transcript costs. Mediation fees. Travel expenses. Many law firms will pay for these costs on the client's behalf and then add the item to the client's next bill. Some firms will ask clients to pay for these costs directly.

How Much Does It Cost To Hire An Insurance Claims Attorney? Wites Law

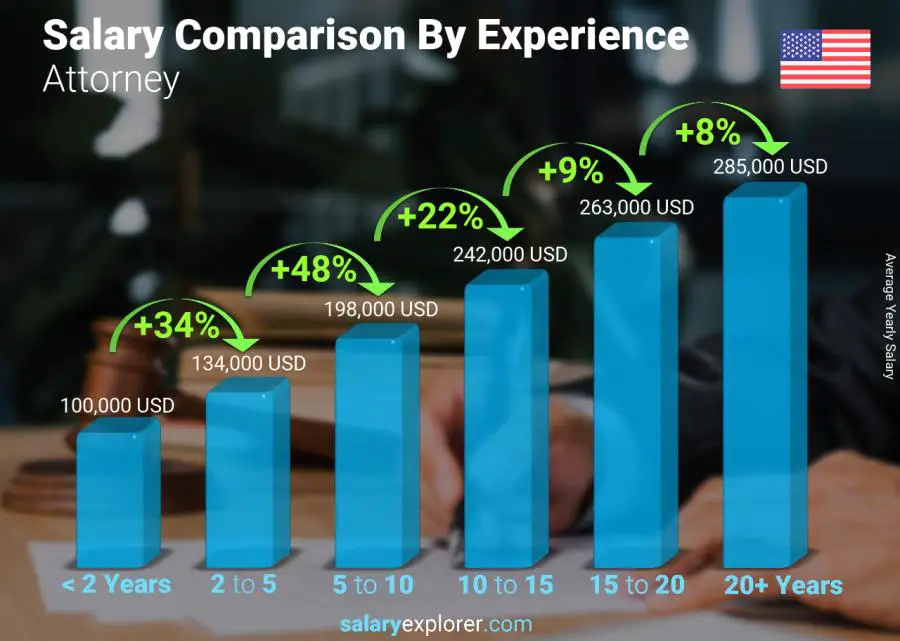

The hourly fee attorneys charge could range from as low as $50 or $100 per hour to as high as several thousand dollars per hour for specialized legal work performed by a top professional.

How Much Do Lawyers Cost in Your State? A Comprehensive Guide Dandy Law

Fortunately, an attorney whose fee is likely to be lower would be interested in working with a small business client. The average cost of a lawyer for a small business client would probably charge an hourly fee in the range of $150 to $500 per hour, again depending on the type of work to be performed, the location and the size and reputation of.

How Much Does A Lawyer Cost?

If you need more information about a commercial litigation issue or have any questions about the cost of litigation, contact the knowledgeable attorney at the Law Offices of Corbett H. Williams at 949-679-9909.

How Much Does a Small Business Lawyer Cost? 6 key Factors The

How much does an employment lawyer cost California? The majority of employment attorneys in California bill employers on an hourly basis. Employment litigation attorney fees in California typically range from $200 to $650 per hour. The primary determinants of an employment lawyer's hourly rate are their level of expertise and years of experience.

How Much Does a Lawyer Cost? UBOMI Beyond money

As of 2020, the average business lawyer hourly rate is between $100 and $400 per hour. Again, this rate can vary greatly depending on the aforementioned factors. Location and type of case will heavily influence an attorney's hourly rate.

How Much Does a Business Attorney Cost? LegalMatch

Starting an LLC costs $70 in California. This is the state fee for filing LLC formation paperwork called the California Articles of Organization. You'll file your LLC's Articles of Organization with the California Secretary of State. And once approved, this is what creates your LLC. The $70 fee is a one-time LLC fee.

How Much Does A Family Lawyer Cost?

FAQs About California Business Lawyer Cost Why Is Business Litigation More Expensive Than Other Business Matters? Attorneys base their fees on many factors, including how difficult they anticipate the case to be and the amount of resources that will be required to navigate the situation.. Jun. 2023 . How Much Does a Business Lawyer Cost.

How Much Does A Business Attorney Cost Paul Johnson's Templates

Starting and running an LLC costs money. How much depends on the state where the LLC is formed. Find out how much it costs to start an LLC in your state.. California: $0 until June 30, 2023: $20 + minimum $800 standard tax: Colorado: $1 until June 30, 2023: $10: Connecticut: $120: $80:. you should reach out to a business lawyer. They can.

How Much Do Lawyers Cost? Rocket Lawyer

Statutory fee. The cost of certain probate and other legal work is set by statute or law. For these proceedings, a court either dictates or must approve the fee you will pay. What you should know about a fee agreement. By law, fee agreements with your lawyer must be in writing when the lawyer expects fees and costs for your case to total $1,000.

How much does a lawyer cost?

Daniel Blomgren. Business Lawyer Serving California. (415) 323-6212. Free Consultation. Offers Video Conferencing. 10.0. San Francisco, CA Business Law Lawyer. TOP RATED LOCAL® SAN FRANCISCO BUSINESS ATTORNEY Named a Rising Star by Super Lawyers, Daniel Blomgren founded Coepio Legal to help entrepreneurs and small business owners found and.

How Much Does a Lawyer Cost? Sinclair Law Firm

A common question to ask before hiring a lawyer is how much legal representation will cost. Let us explore this question and some basic information about corporate lawyers. Based on ContractsCounsel's marketplace data, the average cost of a California corporate lawyer is $150.00 - $575.00 per hour .

How much does it cost to hire a lawyer in the USA? [OL TEH BLOG]

A: The average hourly rate in California for a family law attorney is $363 an hour. This rate may be much higher or much lower based on the individual attorney, their policies, their location, and their experience level. An attorney who has years of experience in family law will charge a higher hourly rate.

Attorney Average Salary in United States 2023 The Complete Guide

Some lawyers bill by the hour for their work, while others quote a flat fee rate, contingency rate, or use retainer fees. Based on ContractsCounsel's marketplace data, the average cost of a lawyer in any legal field is $250 - $350 per hour .